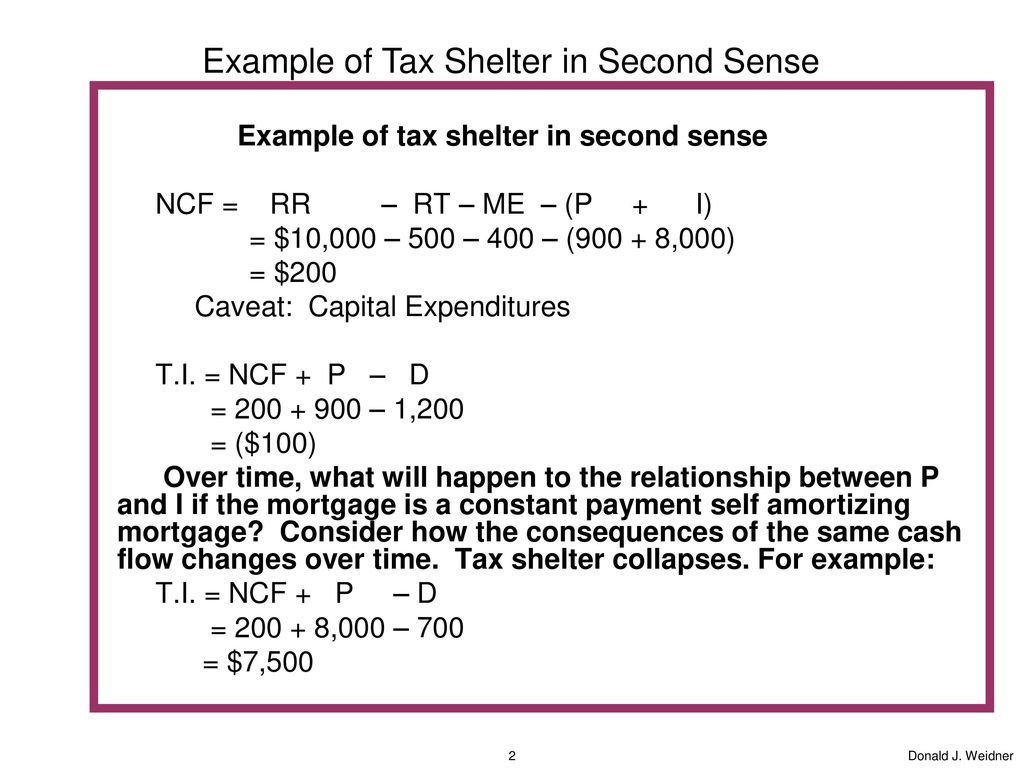

real estate tax shelter example

Italian imperialism in ethiopia. Real estate tax shelter example.

These Real Estate And Oil Tycoons Avoided Paying Taxes For Years Propublica

This paper will document the history of affordable housing practices and focus on the rise in rental prices and the rise in home buying prices within Dallas.

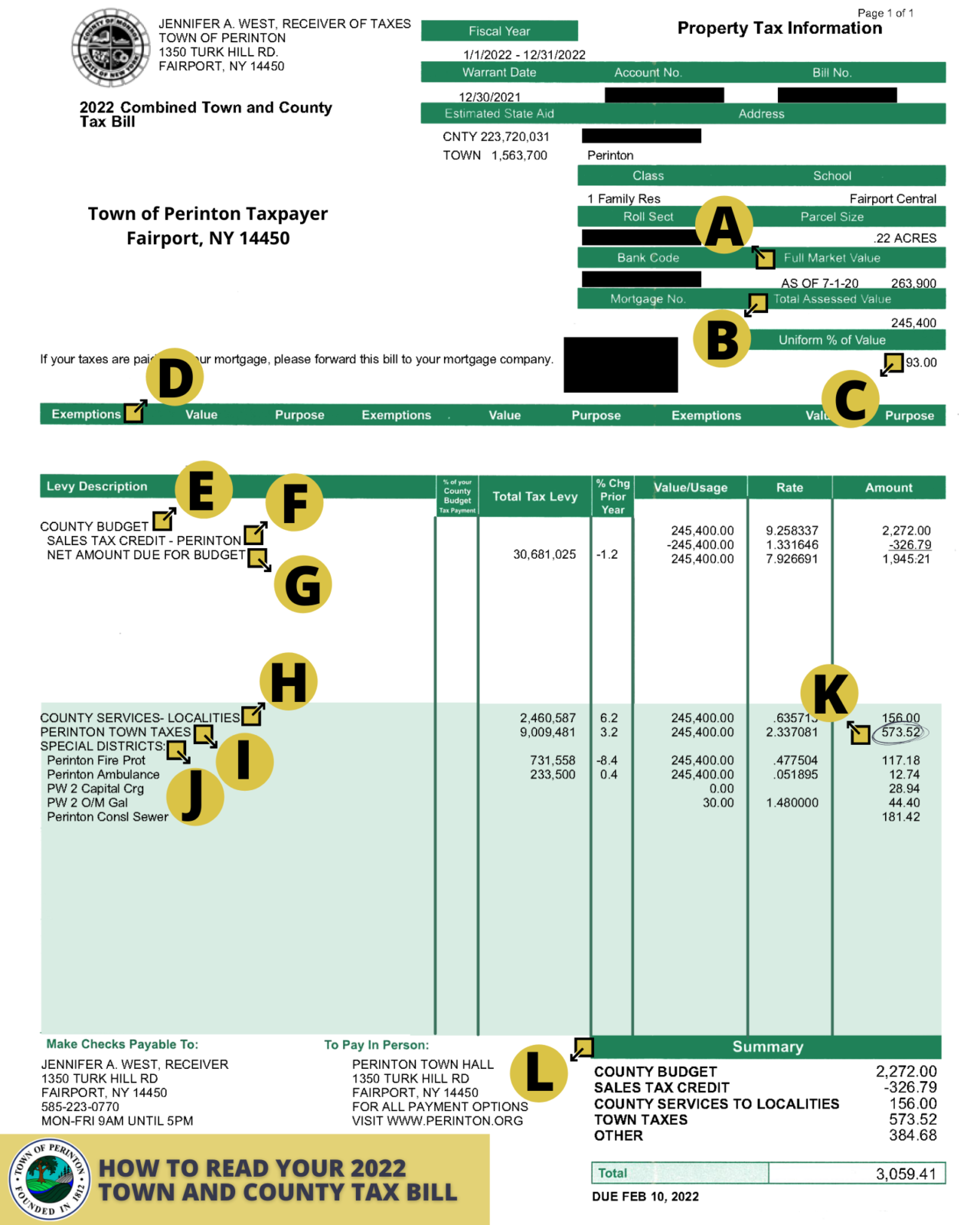

. As an example lets assume that a property has a cash flow of 5000 in other words the cash income from the property. Streamlined Document Workflows for Any Industry. States counties or municipalities can impose RETs.

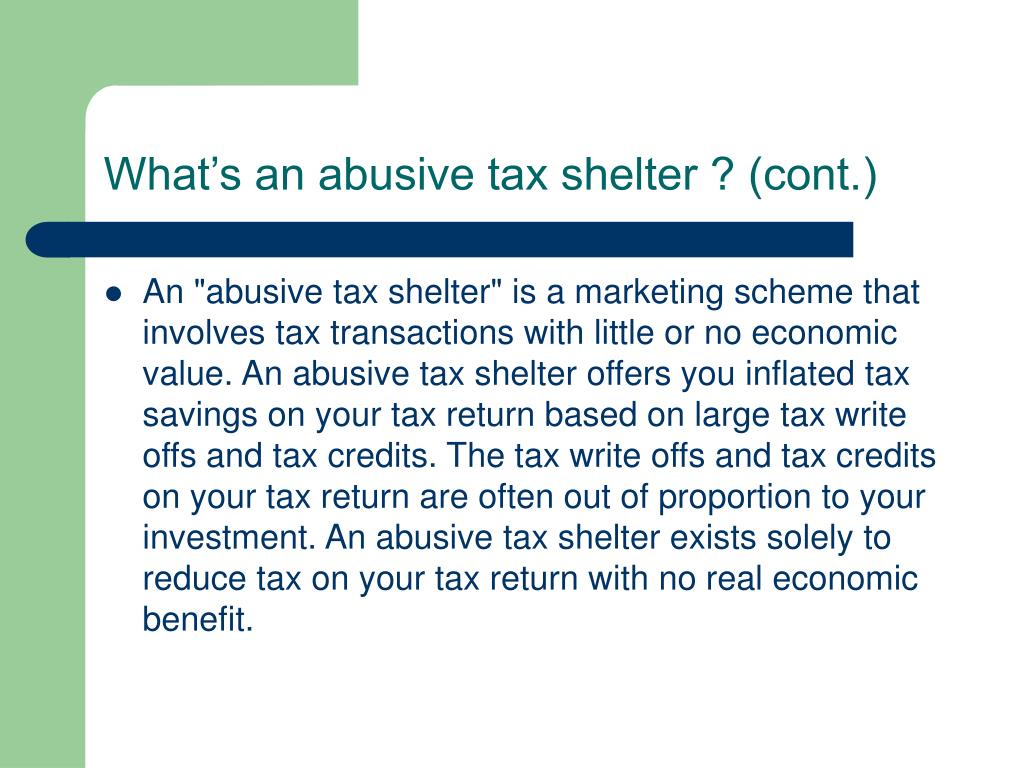

Key Takeaways A tax shelter is a place to legally store assets so that. An abusive tax shelter is an investment strategy that illegally shields assets from tax liability. 23 Returns Last Year.

Property tax in Texas is a locally assessed and locally administered tax. A tax shelter is a vehicle used by taxpayers to minimize or decrease their taxable incomes and therefore tax liabilities. Real estate tax shelter example.

Also known as a real estate transfer tax a real estate tax RET is a tax on passing the home title from one person to another. Tax shelters work by reducing your taxable income thereby reducing your taxes. How Does an Abusive Tax Shelter Work.

Finally this paper aims. Real estate tax shelter example. This is mainly due to its generous tax benefits.

Tax shelters can range from investments or. Tax Lien Examples - Learn the facts of investing in tax lien certificates. Property tax brings in the most money of all taxes available.

A tax shelter is a method used by businesses and individuals to reduce their tax liabilities. Home equity is the. Find Forms for Your Industry in Minutes.

As knowledgeable replacement property professionals they help clients build a customized strategy that identifies suitable investments pursuing successful completion of a. If you have questions about Dallas County Property Taxes please contact. This program is designed to help you access property tax information and pay your property taxes online.

Real estate offers tax sheltering through depreciation operating expenses long-term capital gains and 1031 exchanges. Examples of Tax Shelters. Ad State-specific Legal Forms Form Packages for Investing Services.

214 653-7811 Fax. There is no state property tax. It is common for many individuals or individuals to purchase a home either outright or through a mortgage loan.

Historically real estate has proved to be a significant tax shelter. Records Building 500 Elm Street Suite 3300 Dallas TX 75202. May 14 2022.

The Most Overlooked Tax Breaks For Retirees Kiplinger

Ppt Tax Shelter Powerpoint Presentation Free Download Id 69636

Running For The Tax Shelter Turbotax Tax Tips Videos

What Are Tax Sheltered Investments Types Risks Benefits

Definitive Guide On Irrevocable Life Insurance Trusts

How Is Rental Income Taxed The Advantages Of Being An Owner

How Does The Deduction For State And Local Taxes Work Tax Policy Center

What Are Tax Shelters Turbotax Tax Tips Videos

Introduction To Real Estate Tax Shelter Supplement Pages 53 55 Ppt Download

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

6 Ways To Cut Your Income Taxes After A Windfall Cbs News

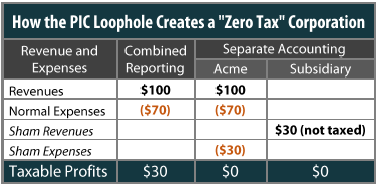

Combined Reporting Of State Corporate Income Taxes A Primer Itep

Warshaw Burstein Llp 2022 Trust And Estates Updates

Cash Accounting Method Unlocked Dallas Business Income Tax Services

9 7 13 Title 26 Seizures For Forfeiture Internal Revenue Service

As Deadline Looms A Look At How Taxes Shaped Our Architecture

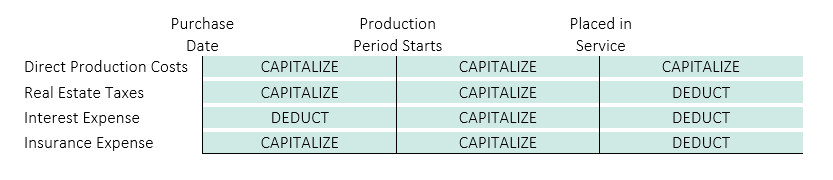

Real Estate Development When To Expense Vs Capitalize Costs Withum